Whar are Leveraged ETFs in the cryptocurrency industry?

The native leveraged ETF products introduced by cryptocurrency exchanges, along with spots and futures, are actually the three main trading products in the cryptocurrency market, according to many crypto investors. However, investors in conventional finance can be unaware of this.

Consider the leveraged ETF that MEXC introduced at the end of 2019. It is a permanent leveraged product that promises to deliver leveraged multiple returns on the benchmarked assets and multiplies the spot price change. For instance, when the BTC spot increases by 1%, BTC3L increases by 3%, while BTC4L increases by 4%; conversely, when the BTC spot declines by 1%, vice versa.

Leveraged ETFs provide advantages over crypto ETFs offered by traditional institutions that the latter cannot match, albeit having slightly less money.

Leveraged ETFs can be traded in the same way as a spot, which simply requires buying and selling, and they can be freely purchased and sold to achieve two-way trading.

Leveraged ETFs also have a compound interest effect, which makes it possible for gains to exceed those from a futures trade with the same multiple, in addition to amplifying spot price changes.

For instance, an investor purchases BTC spot during a unilateral uptrend in BTC. If the spot increases by 5%, the 3x long of the perpetual future may increase by 15% within the same time period. However, if the investor also purchases BTC3L (3x long for Bitcoin), their gain and return will typically be higher than 15%. This is due to the fact that the daily profit is automatically placed into the position and reinvested to produce compound interest under the rebalancing mechanism of leveraged ETFs.

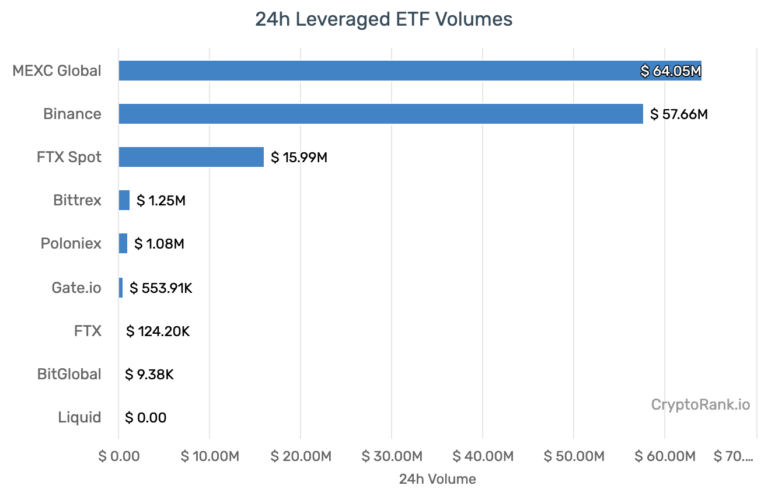

The number of its trading categories is far bigger than those of standard crypto ETFs and ETF products of other platforms, giving MEXC's leveraged ETFs a significant competitive advantage. It offers investors a range of options by supporting the trading of BTC, ETH, XRP, DOT, and more than 400 leveraged ETFs at this time.

BTC, ETH, and other common assets can scarcely do well in the current bad market. However, throughout this negative downturn, LUNC3L and USTC3L soar. LUNC3L experienced a price increase of 1100 percent, going from 0.165 USDT to 1.98 USDT at its maximum point. This is a significant increase over the 196.42 percent gain in the LUNC position.

So how do you use leveraged ETFs to make profits in a downtrend? Again, take BTC as an example. On June 8, the BTC spot fell from 31650 USDT, and BTC3S (3x short for BTC) rose from 0.69 to 2.79USDT. This means that if you buy at the low point, you can get a 304% return.

Comments

Post a Comment