What is Stablecoin?

Because their prices are pegged to a reserve asset such as the US dollar or gold, stablecoins bridge the worlds of cryptocurrency and everyday fiat currency. When compared to Bitcoin, this significantly reduces volatility, resulting in a form of digital money that is better suited to everything from day-to-day commerce to making transfers between exchanges.

The idea of combining traditional asset stability with digital asset flexibility has proven to be extremely popular. Stablecoins like USD Coin (USDC) have attracted billions of dollars in value, becoming some of the most popular ways to store and trade value in the crypto ecosystem.

What can stablecoins be used for?

Reduce volatility: The value of cryptocurrencies such as Bitcoin and Ether fluctuates dramatically, sometimes by the minute. An asset linked to a more stable currency can provide buyers and sellers with confidence that the value of their tokens will not rise or fall unexpectedly in the near future.

Assets can be traded or saved.

Stablecoins do not require a bank account to hold, and they are simple to transfer. The value of stablecoins can be easily transferred around the world, including to places

Earn interest: There are simple ways to earn interest on a stablecoin investment in DeFi products that is typically higher than what a bank would offer. Stablecoins pave the way for traditional financial markets to be integrated with the rapidly evolving DeFi industry. Stablecoins serve as a primary vehicle for cryptocurrency adoption in loan and credit markets, while retaining much of the utility previously reserved for only fiat currency.

Transfer money for free: People have sent as much as a million dollars in USDC for as little as a dollar in transfer fees.

International shipping: Stablecoins like USDC are a good choice for sending money anywhere in the world because of their fast processing and low transaction fees.

How do we classify stablecoins?

Stablecoins are classified according to their operating mechanisms:

Stablecoins with Fiat Collateral

Fiat-collateralized stablecoins are backed by sovereign currency such as the pound or the US dollar, as the name implies. It means that in order to issue a certain number of tokens of a given cryptocurrency, the issuer must provide collateral in the form of dollar reserves worth the same amount.

Commodities such as gold can also be used in this context. The reserves are frequently managed by custodians who operate independently and are regularly audited for compliance. Tether (USDT), which is pegged to the US dollar at a 1:1 ratio and backed by gold reserves, is one cryptocurrency that is backed by dollar deposits.

Another example is the USDC, which is backed by dollar-denominated assets with a fair value at least equal to the USDC in circulation in segregated accounts with US-regulated financial institutions. An independent accounting firm attests to (i.e. publicly verifies) such accounts.

- Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins have the same value as other cryptocurrencies. Because the underlying asset is also a cryptocurrency in this case, it is not conventionally safe and may be highly volatile.

Over-collateralization is a term used to describe these types of stablecoins. It implies that a large number of reserve cryptocurrencies may be required to issue even a small number of tokens.

DAI is the most well-known stablecoin in this category that employs this mechanism. This is accomplished by using MakerDAO's collateralized debt position (CDP) to secure assets as collateral on the blockchain.

For example, if you want to buy $1,000 worth of DAI stablecoins, you must deposit $2,000 worth of ETH — a 200% collateralized ratio. If the market price of ETH falls but remains above a predetermined threshold, the excess collateral stabilizes DAI's price. If the ETH price falls below a predetermined level, collateral is paid back into the smart contract to liquidate the CDP.

- Algorithmic Stablecoins

Non-collateralized stablecoins are those in which no reserve asset is used. Instead, they derive their stability from a working mechanism, such as that of a central bank.

For example, the cryptocurrency base coin employs a consensus mechanism to determine whether the supply of tokens should be increased or decreased on an as-needed basis.

In a crisis, algorithmic stablecoin issuers cannot rely on such advantages. On May 11, 2022, the price of the TerraUSD (UST) algorithmic stablecoin fell more than 60%, effectively destroying its peg to the US dollar, as the price of the related Luna token used to peg Terra fell more than 80% overnight.

How to buy stablecoins?

USDT can be purchased through the MEXC website or app.

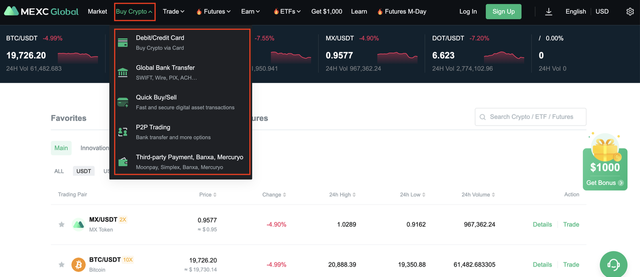

Step 1: Click [Buy Crypto] in the navigation bar. There are five ways to purchase USDT: debit/credit card, bank transfer, peer-to-peer trading.

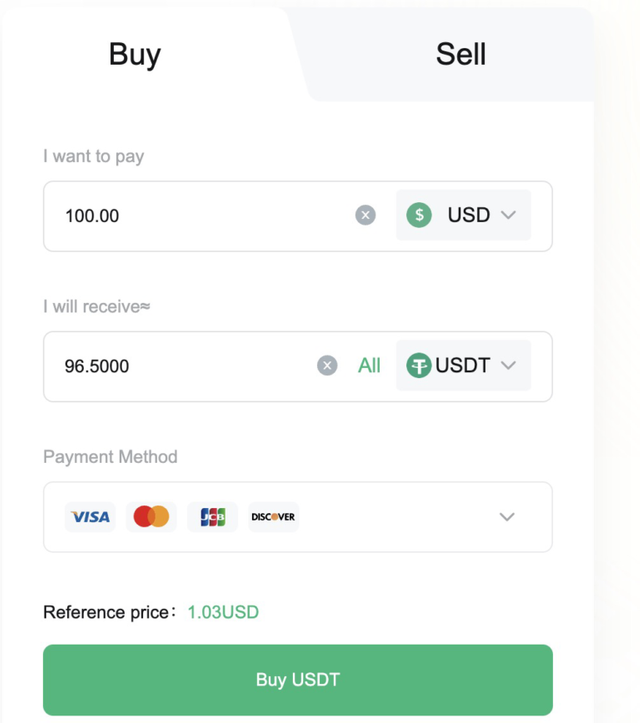

Step2:Choose to buy USDT/USDC/TUSD with different Fiat currencies, just select your currency under each method.

Comments

Post a Comment